Selling Your Business

Our thorough mergers & acquisitions strategy and proprietary process delivers superior results. As your M&A advisor we work alongside shareholders, management and your legal and tax advisors throughout the process.

Our approach to selling businesses has been proven to achieve timely results and to generate maximum value for you with the best terms possible.

Ultimately, it is our job to manage the process of selling your business to ensure that you can continue to effectively run your business with minimal distraction.

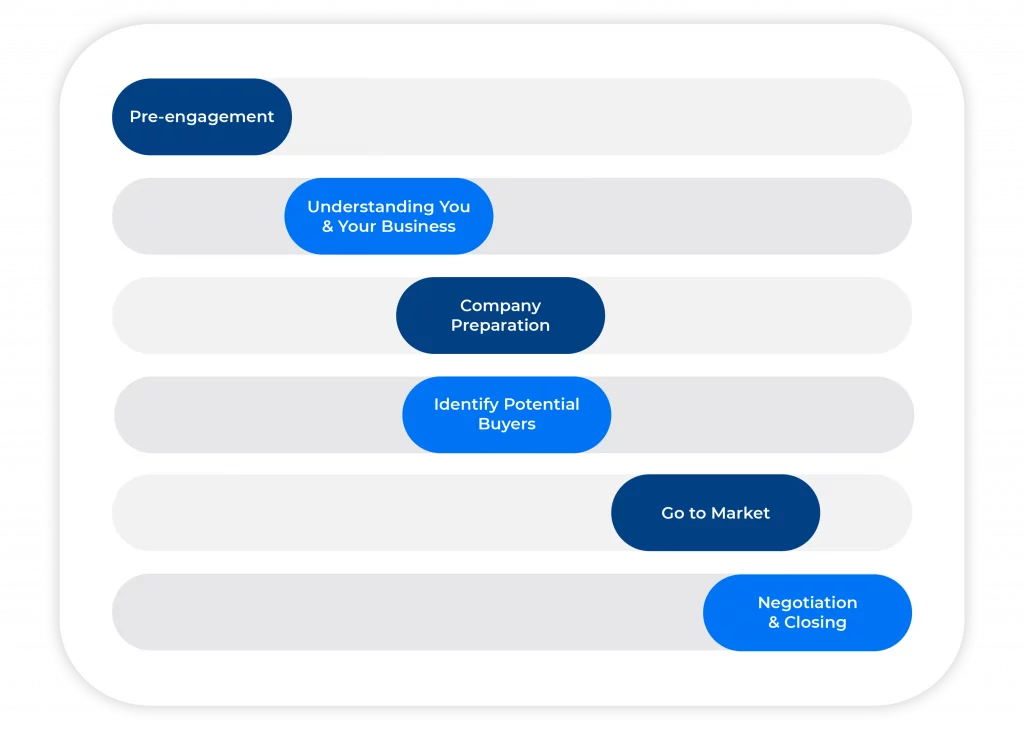

We will work with you through these Sell Side steps:

Pre-engagement

Understanding You & Your Business

Company Preparation

Identify Potential Buyers

Go To Market

Negotiation & Closing

- Final price and structure

- Terms and Conditions – Representations and Warranties

- Working Capital Calculation