Buying a Business

Our thorough and disciplined strategy and our proprietary process delivers superior results. As your M&A advisor we work alongside the shareholders, management and legal/tax advisors throughout the process.

Our approach to helping you buy a business has been proven to achieve timely results and to generate maximum value for our clients with the best terms possible.

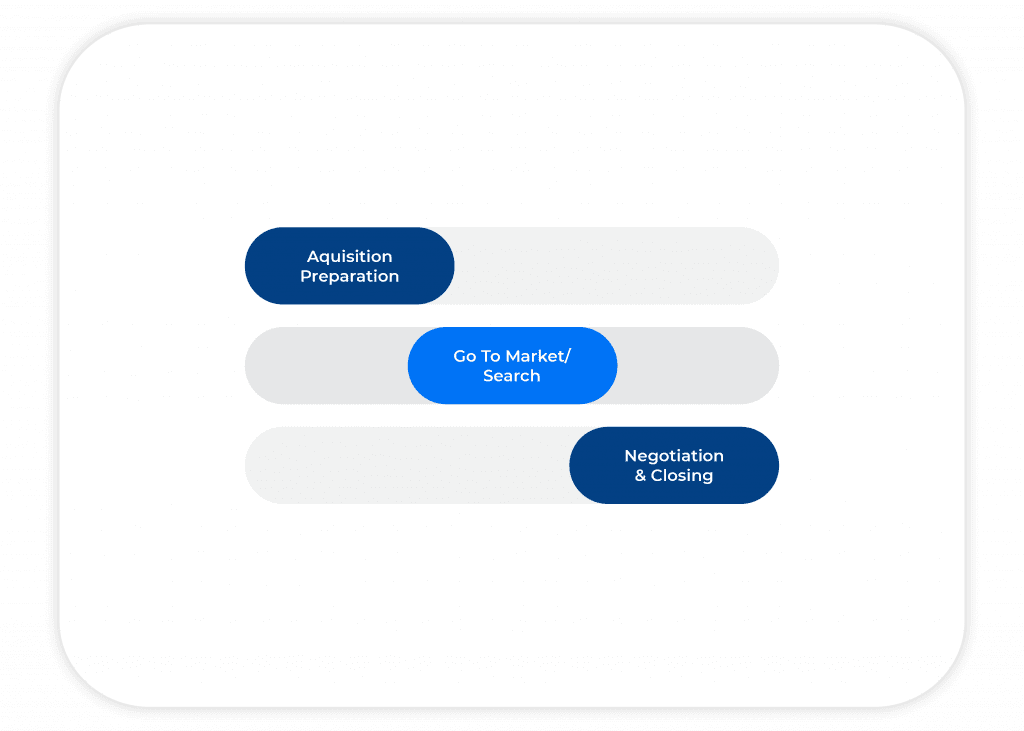

Acquisition Preparation

Go To Market/ Search

Negotiation & Closing

- Final price and structure

- Terms and Conditions – Representations and Warranties

- Working Capital Calculation

Stage Left Partners guides you through the steps of buying a business, beginning with a deep dive into your goals, setting a transaction value range, and crafting specific target criteria. After completing a detailed industry and target identification, we design and implement a robust marketing plan to connect with potential targets. Understanding that buying a business is a time-consuming and sensitive process, we conduct preliminary reviews and due diligence efficiently, with careful management of information and non-disclosure agreements. Utilizing our thorough financial analysis process helps determine valuation ranges and deal structures for each target.

In the crucial negotiation and closing phase, we evaluate acquisition options and aid in target selection. Recommendations and effective strategies are based on comprehensive assessments. We navigate negotiations, including Letter of Intent discussions, and lead due diligence with legal and accounting professionals. The process culminates in the finalization of the definitive agreement, covering critical aspects like price, structure, and terms. At Stage Left Partners, precision and expertise ensure the smooth closure of your acquisition.